The Facts About Eb5 Immigrant Investor Program Uncovered

The Facts About Eb5 Immigrant Investor Program Uncovered

Blog Article

Not known Facts About Eb5 Immigrant Investor Program

Table of ContentsUnknown Facts About Eb5 Immigrant Investor ProgramExcitement About Eb5 Immigrant Investor ProgramThe Ultimate Guide To Eb5 Immigrant Investor ProgramSome Known Questions About Eb5 Immigrant Investor Program.Things about Eb5 Immigrant Investor ProgramThe Eb5 Immigrant Investor Program StatementsThe Facts About Eb5 Immigrant Investor Program RevealedThe Ultimate Guide To Eb5 Immigrant Investor Program

The investor must look for conditional residency by submitting an I-485 request. This petition needs to be sent within six months of the I-526 approval and need to include evidence that the financial investment was made and that it has actually produced a minimum of 10 permanent work for united state employees. The USCIS will certainly evaluate the I-485 petition and either authorize it or request additional proof.Within 90 days of the conditional residency expiry day, the financier should submit an I-829 request to remove the conditions on their residency. This application must include proof that the investment was sustained and that it produced at the very least 10 full-time jobs for United state employees.

Eb5 Immigrant Investor Program Things To Know Before You Buy

dollar fair-market value. The minimum quantity of resources needed for the EB-5 visa program might be reduced from $1,050,000 to $800,000 if the investment is made in a commercial entity that is located in a targeted employment location (TEA). To qualify for the TEA designation, the EB-5 task must either be in a backwoods or in an area that has high unemployment.

workers. These tasks have to be produced within both year period after the financier has actually received their conditional long-term residency. In many cases, -the financier has to have the ability to prove that their financial investment led to the creation of direct tasks for employees that work straight within the business entity that obtained the investment.

Some Known Questions About Eb5 Immigrant Investor Program.

It might be a lot more helpful for a capitalist to invest in a regional center-run job since the capitalist will not have to separately establish up the EB-5 tasks. Investor has even more control over day to day operations.

Capitalists do not need to produce 10 work, but keep 10 currently existing positions. Company is already troubled; hence, the investor may bargain for a much better deal.

Congress offers regional centers top priority, which could indicate a quicker path to authorization for Kind I-526. Nevertheless, USCIS has yet to formally execute this. Financiers do not need to create 10 straight jobs, but his/her investment must create either 10 straight or indirect work. Regional Centers are already established.

The investor needs to reveal the development of 10 jobs or potentially even more than 10 jobs if increasing an existing business. Risky since organization is situated in a TEA. Should generally live in the very same location as the enterprise. If service folds within two year duration, financier might shed all spent funding.

Not known Details About Eb5 Immigrant Investor Program

Intensified by its location in a TEA, this company is already in distress. Should typically reside in the exact same place as the venture. If service folds up within 2 year duration, investor can shed all invested funding. Investor needs to show that his/her investment develops either 10 direct or indirect tasks.

Typically supplied a setting as a Restricted Obligation Partner, so capitalist has no control over everyday operations. The general partners of the regional center business usually benefit from investors' investments. Capitalist has the alternative of spending in any sort of business throughout the united state Might not be as dangerous because investment is not made in a location of high unemployment or distress.

Eb5 Immigrant Investor Program - Questions

Congress gives local centers top concern, which might mean a quicker path to authorization for Type I-526. Financiers do not need to create 10 straight tasks, but their investment must produce either 10 straight or indirect jobs.

If business folds within 2 year duration, investor can lose all invested funding. The investor needs to reveal the development of 10 jobs or possibly even more than 10 jobs if expanding an existing organization.

The capitalist requires to keep 10 currently existing workers for a period of at the very least 2 years. Business is currently in distress. Should usually stay in the click to read very same place as the business. Capitalists may discover infusion of $1,050,000 extremely cumbersome and dangerous. If an investor likes to purchase a local center business, it may be far better to spend in one that only requires $800,000 in investment.

The Ultimate Guide To Eb5 Immigrant Investor Program

Capitalist requires to reveal that his/her investment develops either 10 direct or indirect tasks. The basic companions of the local center firm normally profit from capitalists' top article financial investments.

Not known Details About Eb5 Immigrant Investor Program

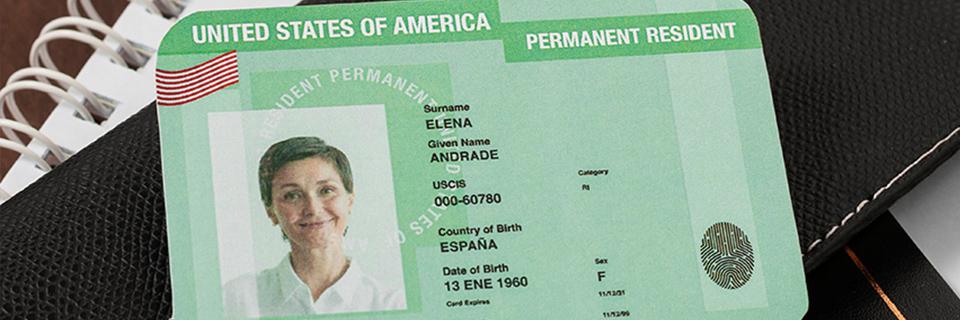

Let's damage it down. The is an existing investment-based migration program made to promote the U.S. economic situation. Developed in 1990, it approves international investors a if they fulfill the following standards: Minimum of $800,000 in a Targeted Employment Area (TEA) or $1. EB5 Immigrant Investor Program.05 million in various other places. The investment needs to develop or protect at the very least 10 permanent work for United state

Funds must be placed in a visit this page business enterprise, venture through direct investment straight financial investment Regional. Lots of EB-5 tasks offer a roi, though profits can vary. Investors can proactively join the U.S. economic climate, profiting from possible company development while securing a path to U.S. permanent residency. Reported in February 2025, the is a suggested choice to the EB-5 visa.

Rumored Buzz on Eb5 Immigrant Investor Program

Unlike EB-5, Gold Card capitalists do not need to produce work. Comparable to EB-5, it can at some point lead to U.S.workers within two years of the immigrant investor's admission to the United States as a Conditional copyright. The investment demand of $1 million is decreased to $500,000 if an investment is made in a Targeted Work Area (TEA).

Report this page